How to Buy Gold as an investment for your Retirement Planning

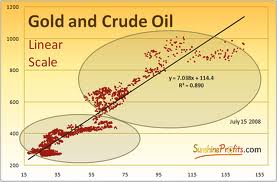

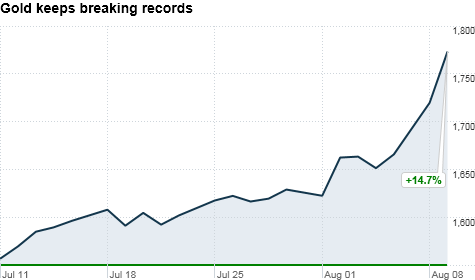

Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and derivatives. The gold market is subject to speculation and volatility as are other markets.

Compared to other precious metals used for investment, gold has the most effective safe haven and hedging properties across a number of countries.

Several refineries and mints produce 1-oz gold bars, Of all the precious metals, gold is the most popular as an investment for diversifying risk, especially through the use of futures contracts and derivatives.

The gold market is subject to speculation and volatility as are other markets.

Compared to other precious metals used for investment, gold has the most effective safe haven and hedging properties across a number of countries.

Most common types of gold to buy

Gold jewelry: In general, jewelry is not a lucrative form of investment.

Retailers add up to a 400 percent markup on gold jewelry, you will not be able to recoup your investment or make money.

Mining stocks: A high-risk, potentially high-profit investment.

Gold bullion: Available online and in gold stores, bullion can be bought as coins or bars.

Find the right dealer!

Take some time to research reputable gold dealers, there are things to consider when you’re looking for a gold dealer:

Price, Dealer buyback policies, Red Flags, Reviews, and Reputation.

Sellers To Stay Away From

- Some websites, Ads, and people you should avoid when buying gold include cold callers, TV ads, Craigslist, online dealers who are offering big discounts, and precious metal companies without a physical address.

- Don’t give in to the pressure of late-night telemarketers insisting you call them immediately for a limited-time discounted rate on gold.

- Take your time to find reputable honest and not pushy dealers.

List of Red Flags

- A Seam Along the Rim

- Watch out for Magnetic Gold (real gold will not stick to a magnet)

- Sold Under Spot Price

- Grainy or Mottled Appearance

- Imperfect Imprint or Lettering

- Too large or Too Light

Mistakes You Want To Avoid

1-Avoid buying proof coins if you are buying gold as an investment.

Proof coinage means special early samples of a coin issue, historically made for checking the dies and for archival purposes, but nowadays often struck in greater numbers especially for coin collectors (numismatists).

Nearly all countries have issued proof coinage.

2-Avoid European Coins

They are not worth the high price, dealers promote European coins because they provide bigger profits and clients have no chance of making any future profit.

3-Avoid Investing in Exploration Mining Stocks

it’s so difficult to find a mine. Only one in about 500 deposits that they drill actually become a mine.

Names of few dealers we have looked at their reviews and policies, you can also investigate before buying.

Perth Mint

Perth Mint 1-oz gold bars are promptly accessible and are one of the two most well known 1-oz gold bars sold in the US, PAMP 1-oz gold bars being the other prominent 1-oz bars. Perth Mint bars are separately wrapped and bundled 25 bars to a holder.

THE BENEFITS OF GOLD IRA ROLLOVER.

PAMP

PAMP one-ounce gold bars once overwhelmed the one-ounce gold bar showcase yet not presently.

Perth Mint bars have made huge advances in the US. PAMP bars, similar to the Perth Mint bars, are .9999 fine (99.99% unadulterated) and come in instances of twenty-five bars.

Each bar is encased in Mylar with a “declaration of realness” imprinted on the cardboard that encompasses the bar.

One side of the PAMP one-ounce gold bars convey the Lady Fortuna outline, which is quickly ending up exceptionally perceived in the United States.

Birch Gold

Birch Gold Group are Precious Metal Dealers that offer customers the opportunity to invest or trade Gold online.

Birch Gold Group provides an IRA scheme that assists investors in managing their retirement portfolio by rolling over their IRA to Gold or Silver.

The Group safeguards the investments which are made by its customers by offering them training and education that is mandatory for their startup and making a move.

Credit Suisse

Credit Suisse one-ounce gold bars are accessible in large amounts, whereas the Perth Mint bars are promptly accessible in little amounts.

Credit Suisse bars are made by PAMP and are basically similar bars except for the outlines.

Credit Suisse bars convey the Credit Suisse trademark, while PAMP bars bear both the PAMP logo and the resemblance of Lady Fortuna.

The Lady Fortuna configuration graces most PAMP gold bars.

Monex Precious Metals

Monex Precious Metals has been dealing in precious metals and IRA-eligible gold and silver coins and bars for over 40 years.

Established in 1967 by Louis E. Carabini, Monex was the first company to enter the precious metals investment industry.

Company Location: Monex Deposit Company 4910 Birch Street Newport Beach, CA 92660

It is one of the eldest companies in the market.

They offer learning tools like seminars, videos and other things for investment in metals, they also provide the customer with the latest change in the price of products to facilitate them before actual trading.

In addition to other products and services, the company deals in gold, and silver IRAs and trade of IRS authenticated metals that are prone to be added to the account.

List of Red Flags

- A Seam Along the Rim

- Watch out for Magnetic Gold (real gold will not stick to a magnet)

- Sold Under Spot Price

- Grainy or Mottled Appearance

- Imperfect Imprint or Lettering

- Too large or Too Light