How to Read Forex Quotes and Understand Currency Pairs: A Beginner’s Guide

How to Read Forex Quotes and Understand Currency Pairs: A Beginner’s Guide

What is a Currency Pair?

Forex quotes are presented in pairs; the first currency represents the base currency, and the second is the quote currency. For instance, in the case of EUR/USD, EUR serves as the base currency, while USD is the quote currency

In Forex trading, currencies are always traded in pairs. This is because you’re simultaneously buying one currency and selling another.

For example:

EUR/USD = 1.1000

This means 1 Euro is worth 1.10 US Dollars.

Base Currency vs. Quote Currency

-

Base Currency: The first currency in the pair (e.g., EUR in EUR/USD)

-

Quote Currency: The second currency in the pair (e.g., USD in EUR/USD)

Think of it like this:

You’re asking, “How many units of the quote currency (USD) do I need to buy 1 unit of the base currency (EUR)?”

🎯 How to Read a Forex Quote

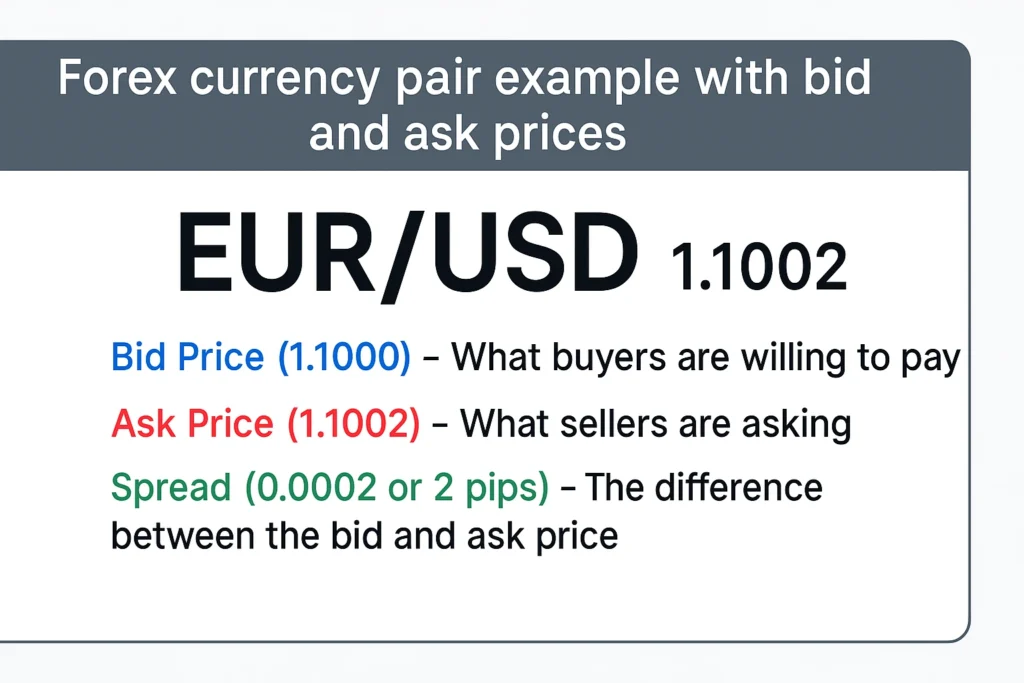

Forex quotes are typically shown with two prices:

Example Quote:

EUR/USD = 1.1000 / 1.1002

- Bid Price (1.1000) – What buyers are willing to pay

- Ask Price (1.1002) – What sellers are asking

- Spread (0.0002 or 2 pips) – The difference between bid and ask price

Example:

If you want to buy, you’ll pay the ask price (higher).

If you want to sell, you’ll receive the bid price (lower).

The difference between the two is called the spread, which is often how brokers make money.

Example in Practice

If you believe the Euro will strengthen against the USD, you would buy EUR/USD.

If you believe the Euro will weaken, you would sell EUR/USD.

💡 Major, Minor, and Exotic Pairs

-

Major Pairs – Most traded and always include the USD (e.g., EUR/USD, GBP/USD)

-

Minor Pairs – Don’t include the USD but involve strong economies (e.g., EUR/GBP, AUD/JPY)

-

Exotic Pairs – Involve one major currency and one from a smaller or emerging economy (e.g., USD/TRY, EUR/SEK)

What Influences Currency Pair Movements

n Forex trading, currencies are always traded in pairs. This is because you’re simultaneously buying one currency and selling another

Forex prices don’t move randomly — they react to real-world events and financial data. The value of a currency pair like EUR/USD can rise or fall due to changes in economic conditions, interest rates, or even breaking news.

Here are the major factors that influence currency pairs:

1. Interest Rates

When a country raises interest rates, its currency tends to strengthen. This is because higher rates attract foreign investors looking for better returns.

Example: If the U.S. Federal Reserve raises interest rates, the USD often gains strength — pushing EUR/USD lower.

2. Inflation and Economic Data

Inflation reports, GDP growth, employment figures, and retail sales data all impact currency strength. Strong data = strong currency.Example: A strong Non-Farm Payroll (NFP) report in the U.S. may boost the USD.

3. Political Stability

Currencies favor countries with stable governments. Political uncertainty can weaken a currency, even if the economy looks strong.

Example: Brexit caused high volatility in GBP/USD due to political risk.

4. Market Sentiment and Risk Appetite

When investors feel confident, they move money into “riskier” currencies (like AUD, NZD). In uncertain times, they flock to “safe havens” like the USD, JPY, or CHF.

Example: During a global crisis, USD/JPY might fall as traders buy JPY for safety.

Bottom Line:

Every currency pair reacts differently to news and data. As a trader, it’s important to understand why a pair is moving — not just how much.

👉 Stay tuned for Lesson 3: “What Moves the Forex Market” where we’ll go deeper into these influences with real-world examples and strategies.

✅ Summary

-

Currency pairs represent the exchange rate between two currencies

-

The first is the base; the second is the quote

-

Forex quotes show the bid and ask prices

-

Knowing how to read these is key to making smart trades

- what influences currency pair movement? Interest rates, Inflation, economic data, political stability,Market sentiment and Risk appetite.