Safeguarding your retirement savings is essential more than ever in these economic times. With the threat of the US dollar and hyperinflation, individuals are currently seeing their retirement assets lose value at a pace that is historical.

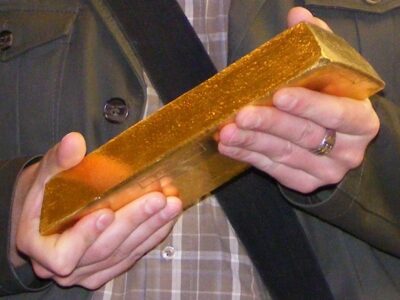

The great news is that those who’re investing in precious metals, like gold and silver, aren’t only securing their assets, they are also seeing a positive Return on investment in a lot of cases especially those who invested in Bitcoin.A physical advantage is something such as property, gold, or silver bullion while a monetary asset is something such as having money in a savings account, bonds, Bitcoins or stocks.Like real estate, have suffered as well.

Metals such as silver and gold have retained their value, but have risen in value in cases although among. Silver has some advantages that you need to consider also while it’s true that gold is the investment choice of both and popular. About investing in silver, the best thing is its value per unit to other metals. Silver is accessible to investors than metals that are higher priced. Which implies that you could invest the same amount of cash into silver, but have many m[/color-box]ore options with regards to selling and buying because of its lower price per unit.

You make certain you’re always in the position to make the most of any increase in the value of both by having a Silver and Gold Rollover IRA. The way to Avoid Tax Penalties by Rolling Over Existing IRAs to a Gold and Silver IRA. Among the biggest concerns, you can have about starting a Gold and Silver Rollover IRA is that the fact that you do not want to have your current IRA loses its tax-deferred status. The great news is that a qualified valuable metals custodian can assist you to Rollover your current resources into a Gold and Silver IRA without suffering any tax penalties. At that, the end, converting your existing assets and IRA into a Gold and Silver or Cryptocurrency like Bitcoin Rollover IRA is the safest and most secure method of safeguarding your retirement savings from various financial factors which may cause major financial losses. Doing a rollover incorrectly may cause you to eliminate your tax-deferred status and result in heavy penalties that may harm your savings just as badly as any financial turmoil.