If you are looking to make fast money with small risk you need to look into Forex Scalping.

Forex Scalping is entering and exiting a position very fast! you will be able to make 20 pips a day and maybe more.

Real Estate Investing

With the highest unemployment since 1982 and the staggering rate that foreclosures are increasing, flipping houses in today’s market can seem like a scary endeavor. Unless you are a savvy real estate investor you would not be thinking about flipping a house or even buying one for that matter. Or would you?

Different Investment Methods

There are many different factors to consider when investing. Each investment option out there can be very powerful if it is done wisely. Some of the most powerful methods of investing are Buying and Selling Stocks, Mutual Funds, Day Trading, Penny Stocks, Bonds, Real Estate, and Tax Liens.

As you can see there are many options for those who are interested in investing. If you do your research it will make your decision much easier.

IQD Iraqi Dinar

This gallery contains 1 photo →

Top Mutual Funds That Are Good Bets For 2018

updated 11/21/2024 1. Fidelity ZERO Large Cap Index (FNILX) Expense Ratio: 0% Overview: Tracks a large-cap index similar to the S&P 500, offering broad market exposure at no cost. 2. Vanguard S&P 500 ETF (VOO) Expense Ratio: 0.03% Overview: Low-cost option for S&P 500 exposure with…

Vietnam’s Dong Hits Record Low Amid US Dollar Surge, Raising Concerns for Further Weakness

This gallery contains 0 photos →

These Stocks Will Rise After Black Friday

updated Oct 24, 2024 Retail Stocks Walmart (WMT) and Target (TGT): Both companies see high sales during Black Friday and the entire holiday shopping season. Walmart and Target often benefit from a strong in-store and online presence, appealing to budget-conscious…

IRA TO GOLD ROLLOVER BENEFITS

This gallery contains 0 photos →

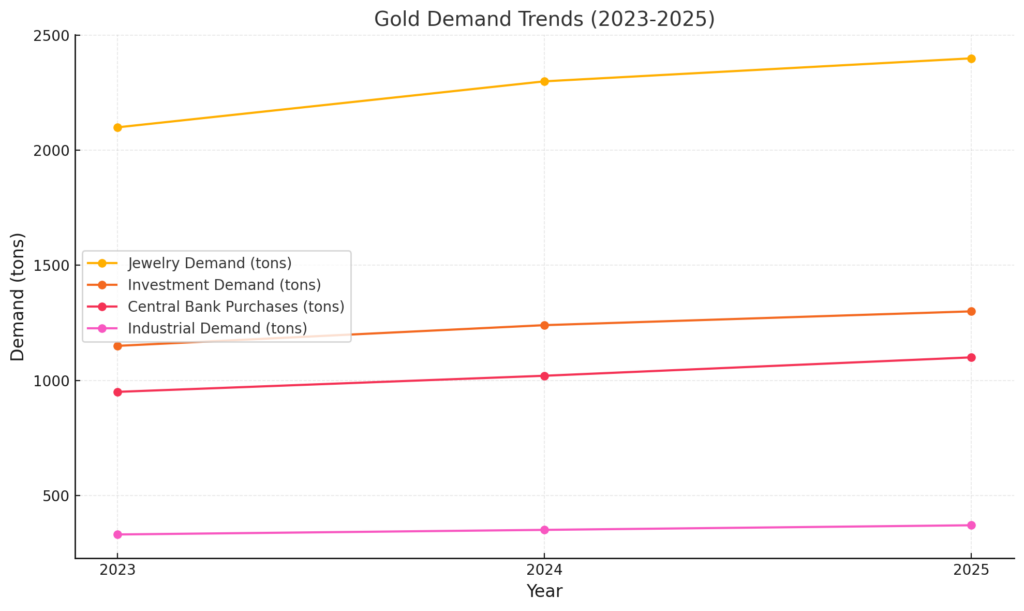

Gold Demand

This gallery contains 1 photo →

How and Where to Buy gold?

Mistakes You Want To Avoid When Buying Gold for Investment!

1-Avoid buying proof coins if you are buying gold as an investment. Proof coinage means special early samples of a coin issue, historically made for checking the dies and for archival purposes, but nowadays often struck in greater numbers especially for coin collectors (numismatists). Nearly all countries have issued proof coinage.

2-Avoid European Coins

They are not worth the high price, dealers promoting European coins because they provide bigger profits and clients have no chance of making any future profit.

3-Avoid Investing in Exploration Mining Stocks

it’s so difficult to find a mine. Only one in about 500 deposits that they drill actually become a mine.