updated November, 2024

Gold Demand Trends: Insights for 2024 and 2025

Gold Demand Overview for 2024

The year 2024 has been a pivotal one for the gold market, characterized by a mix of robust investment demand and strong central bank purchases. Here’s a breakdown of key drivers:

- Investment Demand

- Global uncertainty, including inflationary pressures and a slowdown in major economies, has boosted demand for gold as a hedge.

- Exchange-traded funds (ETFs) and physical gold investments saw a year-on-year increase of 8%, driven by heightened volatility in equity and bond markets.

- Central Bank Purchases

- Central banks, particularly in emerging markets like China and India, continued to accumulate gold reserves to reduce reliance on the US dollar.

- In 2024, central bank gold purchases hit a record high of over 1,000 tons, signaling strong long-term confidence in gold as a reserve asset.

- Jewelry and Technology

- Demand for gold jewelry rebounded in 2024, driven by economic recovery in key markets such as India and China and Dubai

- Technological applications, including electronics and renewable energy technologies, maintained steady demand for gold.

Regional Highlights

- China: The largest consumer of gold in 2024, with increased investment and jewelry demand.

- India: Festivals and wedding seasons fueled jewelry demand, while economic growth supported broader gold purchases.

- United States: Rising inflation drove higher investment demand, with retail investors favoring physical gold.

- Dubai: Often referred to as the “City of Gold,” Dubai remained a key hub for gold trading and consumption in 2024. Its tax-free policies and vibrant jewelry market continued to attract global buyers, particularly from the Middle East, Africa, and South Asia.

Gold Demand Trends: Projections for 2025

Looking ahead to 2025, analysts expect the following trends to shape the gold market:

- Sustained Central Bank Demand

- Central banks are likely to continue diversifying reserves, keeping gold purchases at elevated levels.

- Countries with rising geopolitical risks may accelerate their gold buying.

- Renewable Energy and Technology

- Gold’s use in renewable energy technologies, such as solar panels and hydrogen production, is expected to expand in 2025.

- Advances in electronics manufacturing may also increase industrial demand.

- Price Dynamics

- Gold prices are projected to remain volatile, with analysts predicting a range between $1,900 and $2,200 per ounce in 2025, depending on macroeconomic factors.

Key Challenges and Opportunities

- Challenges: Rising interest rates in some economies could put downward pressure on gold prices, as higher yields make other investments more attractive.

- Opportunities: Increased global economic uncertainty and growing demand in Asia and the Middle East may sustain robust gold demand.

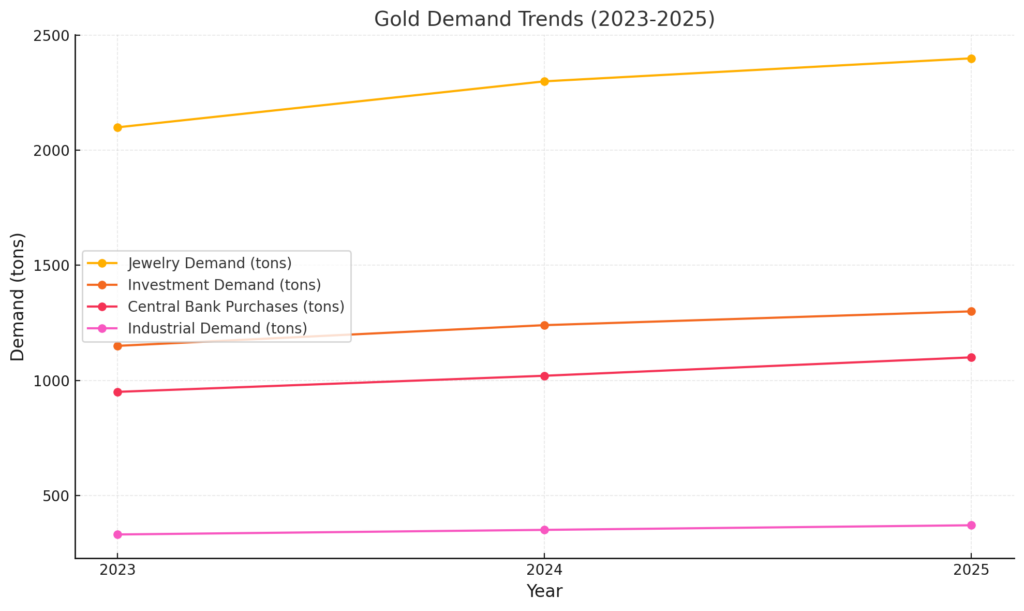

Visualizing the Trends

| Year | Jewelry Demand | Investment Demand | Central Bank Purchases | Industrial Demand |

|---|---|---|---|---|

| 2023 | 2,100 tons | 1,150 tons | 950 tons | 330 tons |

| 2024 (Est.) | 2,300 tons | 1,240 tons | 1,020 tons | 350 tons |

| 2025 (Proj.) | 2,400 tons | 1,300 tons | 1,100 tons | 370 tons |

Conclusion

Gold demand in 2024 has showcased the metal’s enduring appeal across various sectors, from investment to technology. As we move into 2025, gold’s role as a hedge against uncertainty and its increasing applications in technology and renewable energy will likely sustain its demand. Share your thoughts on these trends—what do you think will drive gold demand in the years ahead?

Gold demand in 2018 was 964.3t in Q3, just 6.2t higher y-o-y. Robust central bank buying and a 13% rise in consumer demand offset large ETF outflows.

- A price drop in many markets created a buying opportunity

- Steep losses on many emerging market stock exchanges spurred a flight to safety

- Concerns about further currency weakness prompted investors in some markets to turn to goldThe world’s largest bar and coin market saw significant growth. Demand in China shot up 25% y-o-y and q-o-q to reach 86.5t in Q3, comfortably above its three- and five- year quarterly average of 71.4t and 65t respectively. Investors flocked to gold in Q3 against a backdrop of financial vulnerability. Domestic equities and bonds have suffered in 2018 as trade war tensions have escalated. The CSI 300, China’s leading equity index, dropped 15% to the end of September, and the credit spread between

Bar and coin demand jumped 28% to 298.1t as retail investors took advantage of the lower gold price and sought protection against currency weakness and tumbling stock markets. Jewelry demand rose 6% in Q3 as lower prices caught consumers’ attention.

A growing number of central bank buyers saw demand in this sector rise 22% y-o-y to 148.4t, the highest level of quarterly net purchases since 2015.

Technology registered its eighth consecutive quarter of y-o-y growth, up 1%. Sharp outflows in gold-backed ETFs offset growth across much of the gold market.

Strong central bank and consumer demand offset ETF outflows

Bar and coin investors took advantage of the price dip; demand rose 28% y-o-y.

Stock market volatility and currency weakness also boosted demand in many emerging markets.

China – the world’s largest bar and coin market – saw Gold demand rise 25% y-o-y. Iranian demand hit a five-and-a-half-year high.

Countries & Governments Are Buying Gold

China, Brazil, Russia, India, and South Africa

Q3 jewelry demand saw price-led y-o-y growth of 6%. Lower gold prices during July and August encouraged bargain hunting amongst price-sensitive consumers. Growth in India and China outweighed weakness in the Middle East.

Central bank gold reserves grew 148.4t in Q3, up 22% y-o-y. This is the highest level of net purchases since 2015, both quarterly and y-t-d, and notable due to a greater number of buyers.

Demand for gold in technological applications rose in Q3 by 1% y-o-y, to 85.3t. This marks the eighth consecutive quarter of growth, primarily driven by gold’s use in electronics such as smartphones, servers, and automotive vehicles.

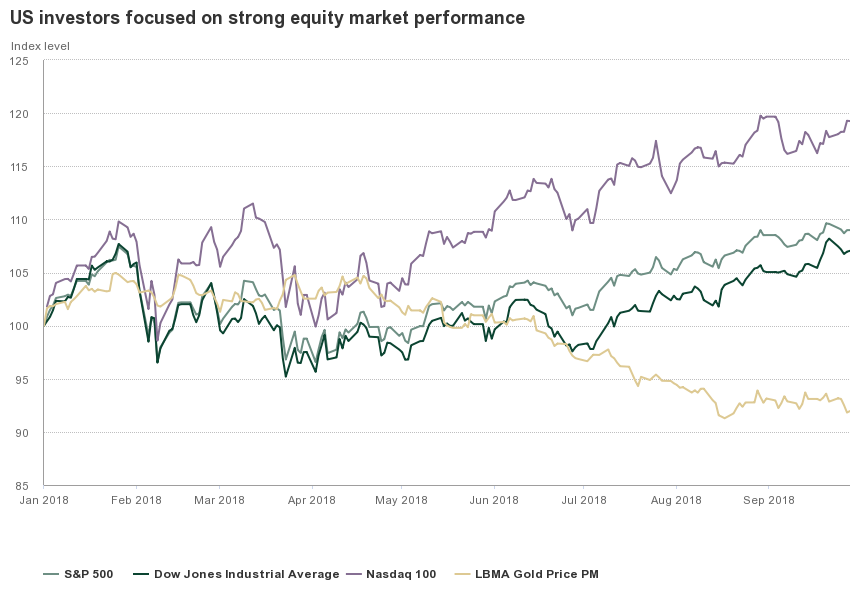

ETFs shed 103.2t in Q3. ETFs saw a 116t decline when compared with inflows of 13.2t in Q3 ’17, experiencing the first quarter of outflows since Q4 2016. North America accounted for 73% of outflows, fuelled by risk-on sentiment, the strong dollar, and price-driven momentum.

Investment

Significant outflows from gold-backed ETFs; sharp rise in Gold demand

- ETFs shed 103.2t in Q3. North America accounted for 73% of outflows as investors focused on rising equities and strong economic growth

- Bar and coin investors around the world took advantage of the price dip; demand rose 28% y-o-y

- Stock market volatility and currency weakness was a catalyst for demand in many emerging markets

| Tonnes | Q3’17 | Q3’18 | YoY | |

|---|---|---|---|---|

| Investment | 246.2 | 194.9 |  |

-21% |

| Bar & coin | 233.0 | 298.1 |  |

28% |

| India | 31.0 | 34.4 |  |

11% |

| China | 69.3 | 86.5 |  |

25% |

| Gold-backed ETFs | 13.2 | -103.2 |  |

– |

ETFs

Global gold-backed ETFs saw the first quarterly outflows since Q4 2016: AUM fell by 103.2t over the quarter. This represents a 116t decline when compared with inflows of 13.2t in the same period last year. While flows decelerated towards the end of the quarter, September nonetheless was the fourth consecutive month of outflows, creating the longest period of monthly outflows since 2014. This wiped out gains made earlier in the year: by the end of Q3, global gold-backed ETFs had shed 42t. The trend in October, however, seemed to have reversed as ETFs have generally seen positive flows across regions.

The overall decline masks notable regional differences. North America, home to the largest and most liquid gold-backed ETFs, accounted for 73% of outflows in Q3 (around 75t) and almost 90% of outflows over the course of the year so far.

This bearish sentiment towards gold was also present in the US futures market with COMEX reported managed money net longs falling to the lowest level since 2006 and speculative net long positioning turning negative for the first time since 2001.

This is large because of the positive macroeconomic backdrop in the US. Equity markets performed well, with the S&P500, Dow Jones, and Nasdaq all hitting record highs in Q3.

The economy is motoring, inflation is edging up and the Federal Reserve is expected to continue tightening monetary conditions.

And after the low levels of Q1, the US dollar has rebounded and remained relatively strong since. US investors have, by and large, shrugged off concerns around escalating trade war tensions.

US investors focused on strong equity market performance