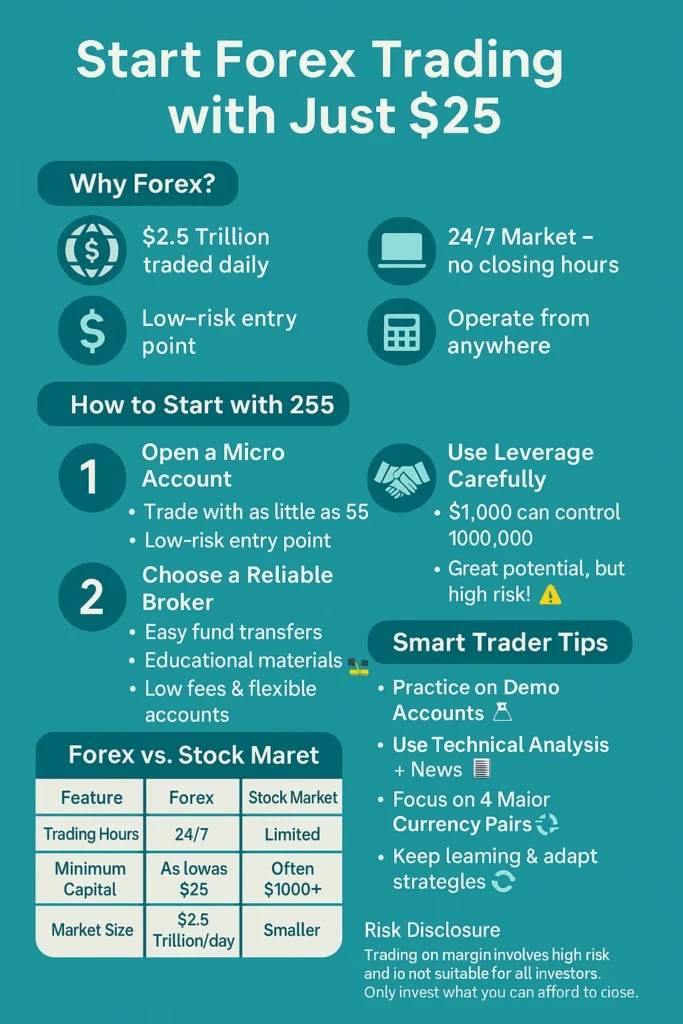

Here are some tips you can benefit from before you start Trading.

We recommend that you start with Demo Account first for few months and then Micro-Account, start with $25 or $100, then you can start with Mini-Account.

After a year of trading with your mini-account, you should have enough skill and confidence to broaden your portfolio.

1. Trade in the direction of the trend. The spot forex is a large market and the trends, momentum, and movement cycles tend to last longer than other financial markets. If you don’t know the trends of the forex or consistently trade against it will cause pain and losses.

2. Place a Stop Loss Order. To prevent a large loss from an unexpected news events correctly place a stop loss order. A stop loss order instructs your broker to sell when the price hits a certain point. The purpose of the stop loss is obvious – you want to get out of the stock before it falls any farther.

3. When you are trading multiple currency pairs in your trading account, always make sure you’re aware of your risk exposure, many pairs tend to move in the same direction.

5. Know what moves currency markets. There are a number of factors that drive a currency’s performance. A country’s economic data releases, policy decisions, and political events can change an economist’s outlook on the country, and therefore its currency. Technical factors such as interest rates and international trade can have an impact on the market.

The market only moves in three directions: upward, sideways, or downward.

Highs

Tip 6

Manage risk. You must decide how much money you’re willing to lose.

Tip 7

Treat your trading like a business. In any Business you keep costs as low as possible and revenue as high as possible. In forex trading this is done by effectively managing the risk to reward on every trade you take.

Tip 8

Trade the Currency Pair you know. Each currency pair have own characteristics and considerations to understand and analyze. If you’re trading as part-time and non-professional basis, it is probably better to concentrate on just two pairs and commit to thorough study on those.

Tip 9

Key things to consider when analyzing a currency pair are its liquidity, transaction costs (the spread), and volatility. As a general rule, major currencies usually have better liquidity, tighter spreads, and lower volatility, versus emerging-market currencies.

Tip 10

Plan your trade, and trade your plan. The markets are fast moving and in the short-term can be unpredictable, stick to your long-term plan based on your research, good currency traders make money in the long term by being disciplined, not necessarily by making short-term bets.

Tip 11

Keep emotion out of any trading decision you make. Trading psychology has to do with the emotional state of mind when trading. Many people fail in Forex trading because of emotions and trading anxiety. You have to take charge of your emotions, eliminate any trading anxiety and be confident.

Tip 12

Don’t expect to win on every trade. don’t be discouraged if you lose one trade; review the reasons you didn’t win and see if there is anything to learn from the experience. But don’t think that currency trading is an option for those seeking quick money, because like any investment, it only should be played by those with a long-term goal in mind.

Risk disclaimer Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all investors. You could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.