There are plenty of resources for online Forex trading. Many guiding manuals are offered free online, information websites, technical and fundamental analysis of the market, charts and news-updates registered with the system and even hands on training online. The forex reviews and market trends based on stock research should also be made accessible.

Author: AdmaD

AdmaD is a seasoned professional in Forex trading with a background in financial services and investments. Previously associated with Dukascopy Bank SA Switzerland, studied forex trading, insurance, real estate, and mortgage banking and extends to alternative investment strategies, particularly in Gold and Silver Investments, IRA Rollover services, and Commodity Online Trading.

Volatility and Risk

This gallery contains 0 photos →

The Golden Yuan Is Coming – Here’s How to Play It

This gallery contains 0 photos →

What is Bitcoin?

What is Bitcoin? (Updated 2024)

Bitcoin (BTC) is the first and most widely recognized cryptocurrency, a form of decentralized digital currency that operates without the need for a central authority such as a government or financial institution. It was introduced in 2009 by an anonymous entity known as Satoshi Nakamoto.

Bitcoin (BTC) is the first and most widely recognized cryptocurrency, a form of decentralized digital currency that operates without the need for a central authority such as a government or financial institution. It was introduced in 2009 by an anonymous entity known as Satoshi Nakamoto.

How Bitcoin Works in 2024

Bitcoin transactions are powered by blockchain technology, a secure, decentralized ledger that records all transactions on the network. Here are some key components to include:

- Decentralization: Bitcoin is maintained by a network of computers (nodes) across the globe, making it resistant to censorship and control by any single entity.

- Mining: Miners validate transactions and secure the network by solving complex cryptographic puzzles, earning newly minted bitcoins as rewards.

- Limited Supply: There will only ever be 21 million bitcoins, a feature designed to ensure scarcity and protect against inflation.

- Halving Events: Bitcoin undergoes “halving” approximately every four years, reducing the mining reward by half. The most recent halving occurred in April 2024, reducing rewards to 3.125 BTC per block.

Why Bitcoin Remains Relevant in 2024

- Institutional Adoption:

- Companies like Tesla, MicroStrategy, and even governments (e.g., El Salvador) continue to hold Bitcoin as a hedge against inflation.

- Several ETFs (Exchange-Traded Funds) based on Bitcoin futures or spot prices have gained traction in financial markets.

- Global Usage:

- In countries with hyperinflation (e.g., Venezuela, Turkey), Bitcoin serves as a viable alternative to unstable fiat currencies.

- It remains a preferred method for remittances due to its low fees and fast transaction times.

- Layer 2 Solutions:

- The Lightning Network has made Bitcoin transactions faster and cheaper, improving scalability for everyday use.

- Regulatory Landscape:

- Governments worldwide are introducing clearer regulations on cryptocurrency. In 2024, the U.S. passed new tax laws aimed at simplifying crypto reporting for retail investors.

Risks and Challenges

- Volatility: Despite its growing adoption, Bitcoin’s price remains highly volatile, influenced by macroeconomic trends, regulatory news, and market sentiment.

- Environmental Concerns: Although Bitcoin mining’s environmental impact has decreased due to renewable energy adoption, it remains a contentious issue.

- Competition: Newer cryptocurrencies and blockchains, such as Ethereum (ETH), Solana (SOL), and Cardano (ADA), offer different functionalities and may rival Bitcoin’s dominance.

Bitcoin in Numbers (2024)

- Market Cap: $X trillion (update with live data at the time of publishing).

- Price: $X (update).

- Adoption: Over 400 million crypto users globally, with Bitcoin accounting for approximately 50% of the total market cap.

Conclusion

Bitcoin continues to lead the cryptocurrency market in 2024, evolving from a niche digital currency to a mainstream financial asset. Whether you’re a beginner or an experienced investor, understanding Bitcoin is essential in today’s financial landscape.

Bitcoin’s Role as a Digital Gold

Bitcoin continues to lead the cryptocurrency market in 2024, evolving from a niche digital currency to a mainstream financial asset. Whether you’re a beginner or an experienced investor, understanding Bitcoin is essential in today’s financial landscape.

Often referred to as “digital gold,” Bitcoin is increasingly viewed as a store of value and a hedge against economic uncertainty. Its fixed supply and decentralized nature make it attractive to investors seeking an alternative to traditional assets like gold.

Bitcoin is the most important cryptocurrency in the market

By: Tal Yellin,Dominic Aratari,Jose Pagliery / CNNMoney

Bitcoin Cash holds an important place in the history of altcoins because it is one of the earliest and most successful hard forks of the original bitcoin.

In the cryptocurrency world, a fork takes place as taresult of debates and arguments between developers and miners.

Due to the decentralized nature of digital currencies, wholesale changes to the code underlying the token or coin at hand must be made due to general consensus; the mechanism for this process varies according to the particular cryptocurrency.

When different factions can’t come to an agreement, sometimes the digital currency is split, with the original remaining true to its original code and the other copy beginning life as a new version of the prior coin, complete with changes to its code.

Bitcoin cash began its life in August of 2017 as a result of one of these splits.

The debate which led to the creation of BCH had to do with the issue of scalability; bitcoin has a strict limit on the size of blocks, 1 megabyte.

BCH increases the block size from 1 MB to 8 MB, with the idea being that larger blocks will allow for faster transaction times.

It also makes other changes, too, including the removal of the Segregated Witness protocol which impacts block space.

As of October 5, 2018, BCH had a market cap of $1.88 billion and a value per token of $114.30.

Why Bitcoins?

Bitcoins can be used to buy merchandise anonymously. In addition, international payments are easy and cheap because bitcoins are not tied to any country or subject to regulation.

Small businesses may like them because there are no credit card fees. Some people just buy bitcoins as an investment, hoping that they’ll go up in value.

Acquiring Bitcoins

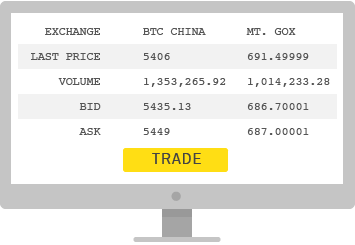

Buy on an Exchange

Several marketplaces called “bitcoin exchanges” allow people to buy or sell bitcoins using different currencies.

Mt. Gox is the largest bitcoin exchange.

Transfers of Money and Payment

People can send bitcoins to each other using mobile apps or their computers. It’s similar to sending cash digitally.

Mining

People compete to “mine” bitcoins using computers to solve complex math puzzles.

This is how bitcoins are created. Currently, a winner is rewarded with 25 bitcoins roughly every 10 minutes.

Owning Bitcoins

Bitcoins are stored in a “digital wallet,” which exists either in the cloud or on a user’s computer.

The wallet is a kind of virtual bank account that allows users to send or receive bitcoins, pay for goods or save their money.

Unlike bank accounts, bitcoin wallets are not insured by the FDIC.

Wallet in cloud:

Servers have been hacked.

Companies have fled with clients’ Bitcoins.

Wallet on a computer:

You can accidentally delete them. Viruses could destroy them!

Anonymity

Though each bitcoin transaction is recorded in a public log, names of buyers and sellers are never revealed – only their wallet IDs.

While that keeps bitcoin users’ transactions private, it also lets them buy or sell anything without easily tracing it back to them.

That’s why it has become the currency of choice for people online buying drugs or other illicit activities.

Future in question

No one knows what will become of bitcoin.

It is mostly unregulated, but that could change.

Governments are concerned about taxation and their lack of control over the currency.

CONCLUSION

As you know, Bitcoin has taken a big dive this year 2018.

Here’s what most people don’t know:

A massive system upgrade to Bitcoin is expected to go live at any time!

Cryptocurrency experts believe that when it does happen, the price of Bitcoin will go up to more than $100,000 a coin!

Why the upgrade of the payment system will bring the prices to go up?

Until now, the biggest problem with Bitcoin has been that it’s virtually useless as an actual form of money.

In its current form, payment transactions are slow and the costs are extremely high.

Bitcoin has stood firmly in the media for the last two years. Like other innovative ideas, even if Bitcoin loses relevance, cryptocurrencies have made a point: there are feasible alternatives to institutionally backed internet transactions.

This month, daily Bitcoin transactions surpassed 100,000. The number of transactions has increased while Bitcoin price has remained relatively stagnant over the short-term, indicating stable growth trends.

Criminal activity and the use of Bitcoin in black markets

On the “Deep Web” remain a serious concern for federal law enforcement agencies. The popularity and anonymity of Bitcoin make it an appealing alternative to criminals who previously relied entirely on cash and banks.

Regulations

The largest obstacle for regulators is that Bitcoin was built not to be regulated. Unlike the centralized U.S. dollar system, where the government has monopoly control over the production of money and doles it out to licensed banks, the Bitcoin universe is decentralized by design.

They’re produced by random players around the world.

They’re transferred seamlessly via nameless digital wallets.

Regulations News From Around the World

Switzerland

Crypto Funds Gets Greenlight from Swiss Financial Markets Regulator

In a move that clearly shows the government’s resolve to encourage investments in cryptocurrencies.

Switzerland’s financial markets regulator has opened the floodgates for institutional participation in cryptocurrencies.

Zug-based Crypto Finance AG subsidiary Crypto Fund AG becomes the first company to get the green light from the Swiss Financial Market Supervisory Authority (FINMA) to offer a wide range of blockchain-based assets to institutional investors in the country.

Crypto Fund was granted a limited license earlier this year to distribute “offshore-based cryptocurrency” funds to qualified investors, but the new license from FINMA empowers the Fund to legally act as an asset manager that can offer investment advice and issue an array of investment products that “tracks bitcoin and other cryptocurrencies,” including Swiss-based funds.

Former UBS banker Jan Brzezek founded the Fund in 2017 under the country’s Collective Investment Schemes Act (CISA.) While commenting on the approval from the regulators, Brzezek said the importance of crypto assets could not be overemphasized, and his company’s goal is to “accelerate maturity” in the market it currently operates.

“Regulatory recognition remains highly sought after by participants, as seen in recent press and company statements.”

Mathias Maurer, the chief operating officer of Crypto Fund AG went on to state:

“The authorization represents our professional work over the last 12 months and is a major milestone for us. Our thanks go, above all, to our partners who made this ground-breaking authorization possible and to FINMA for the good cooperation.”

Japan

On October 20, The Bank of Japan’s (BOJ) deputy governor, Masayoshi Amamiya, repeated his negative stance towards central bank-issued digital currencies or national digital currencies (CBDC), claiming that such digital currencies are unlikely to improve the existing monetary systems.

The concept of CBDC, or national cryptocurrencies, has attracted many governments across the world.

Some of them have already rolled out their virtual currencies, some keep researching their economic impact, while others — like Japan — have decided to dismiss the idea altogether.

Spain

Spain Approves Law Requiring Citizens to Disclose all Crypto Holdings!

The Spanish Ministry of Finance has closed a legal loophole allowing holders of bitcoin and other cryptocurrencies to skirt asset declaration laws.

Announcing a draft anti-fraud law approved by the Council of Ministers earlier today.

Finance Minister María Jesús Montero explained that the new law will mandate “the identification of the holders and the balances contributed by these virtual currencies, ” obligating crypto asset holders to declare all cryptocurrency asset holdings.

Spanish daily newspaper ABC.es reports that Montero further stated that all Spaniards with offshore currency holdings in fiat or crypto must declare these holdings in an annual declaration to Spain’s Agencia Tributaria.

New Spanish Taxation Measures Affecting Crypto Holders

India

Indian Govt. Panel Could Propose Illegalizing Holding of Unregulated Crypto Assets: Report

It could soon be illegal in the world’s largest democracy to hold cryptocurrencies that lack the government’s seal of approval.

According to Moneycontrol, a report which is being prepared by a committee headed by India’s Economic Affairs Secretary, Subhash Chandra Garg, may propose amendments to the existing laws with a view of making it illegal to hold crypto assets that are not approved by the government.

Per the reports from the Indian financial publication, the Subhash Garg-committee is in the final phase of deliberations. Besides merely proposing legislative amendments and recommending punishment for those holding unapproved crypto assets, the panel will also define the punitive measures that will be meted on those who flout the law.

It is understood that this move stems from the government’s view that crypto assets which are unregulated should be kept out of the Indian financial ecosystem to prevent them from being used to aid illegalities such as evading taxes as well as in Ponzi and multi-level marketing schemes.

Zambia

Bitcoin is Not a Legal Tender in Zambia, Says Central Bank

Zambia’s central bank has said that cryptocurrencies like bitcoin aren’t legal tender in the country.

The Bank of Zambia (BoZ), responsible for creating and implementing monetary policies for the world’s 105th largest economy, explained their stance against the use of cryptocurrencies in contrast to the growing public interests in the field.

The central bank admitted that it was receiving a lot of inquiries related to Bitcoin’s legal status in Zambia, and they had to “safeguard the interests of members of the public and to maintain the integrity of the financial system” with its official stance on the digital currency, according to a local news report.

Make Fast Money Trading Binary Options

A binary option trading is the best online trading option available to earn good profit in short time. Binaries considered to be one of the simplest trading products out there, as the constructed investment product the trader know at the time of the trader what is the maximum profit and loss. Binary options trading is the best online trading option available to earn good money in a short period of time.