The Real State of the Union: A Rescue Plan for the U.S. Economy

[Editor’s Note: This is the second installment of a two-part interview with Money Morning Chief Investment Strategist Keith Fitz-Gerald. Here in Part II, the investing veteran details his fix-it plan for the U.S. economy. In Part I, which appeared yesterday (Thursday), Fitz-Gerald outlined an investment strategy for 2011.]

Money Morning Staff Reports

If Money Morning’s Keith Fitz-Gerald were granted an audience with U.S. President Barack Obama and Federal Reserve Chairman Ben S. Bernanke, the one message he’d deliver is this: It’s time to stop the gravy train and reform the U.S. financial system once and for all.

In fact, this may be our last chance.

“If I had the chance to sit down with President Obama and Fed Chairman Bernanke, I would offer [them an] eight-point plan that’s designed to increase growth, provide jobs and increase America’s international competitiveness,” says Fitz-Gerald, a well-known commentator and bestselling author who is Money Morning’s chief investment strategist.

In this second installment of a two-part interview with Money Morning Executive Editor William Patalon III, Fitz-Gerald took the time to outline that eight-point rescue plan for the U.S. economy. In that plan, the changes Fitz-Gerald calls for include:

• Cuts in federal spending.

• Pension reforms at all levels.

• A halt to weak-dollar policies.

• And a realization by Washington that it’s time to take China much more seriously.

In Part I of this interview, which appeared yesterday (Thursday), Fitz-Gerald assessed the health of the U.S. and global economies, provided his outlook for the U.S. stock market and for commodity prices, and even offered an investment strategy for 2011.

The highlights of Part II follow below. And if you missed Part I, you can access yesterday’s story by clicking here.

Money Morning (Q): In Part I of this interview, we covered a lot of ground, talking about the outlook for stocks, commodities and even the U.S. economy. Speaking of the economy, it’s clear that we’ve reached a critical point with regard to debt – and by a critical point, I mean that it seems to be now or never if we’re going to actually do something about U.S. government debt levels. I know from our many talks that you agree. If you could sit down with U.S. President Barack Obama, and U.S. Federal Reserve Chairman Ben S. Bernanke, what advice would you give them? What kind of a game plan would you sketch out?

Keith Fitz-Gerald: I’ve actually been waiting for a question just like this for awhile now, Bill. Thanks for asking. If I had the chance to sit down with President Obama and Fed Chairman Bernanke, I would offer the following eight-point plan that’s designed to increase growth, provide jobs and increase America’s international competitiveness:

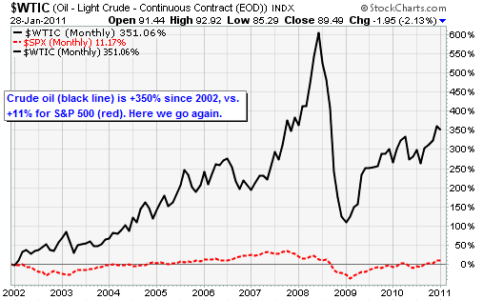

1. Stop the weak-U.S. dollar policies that have drawn the ire of nations around the world – and for which China is openly deriding us. These policies are encouraging rampant-interest-rate speculation, increasing oil prices (which are priced in dollars) and undermining our currency – none of which are conducive to a vibrant economy. Raise the benchmark Fed Funds rate immediately, then peg it to something like oil or gold or some combination of currencies plus natural resources. This will remove uncertainty and immediately show governments and investors around the world that the dollar does, indeed, matter and that their faith in our debt is not misplaced. Weak money is the enemy and it craters the very middle class our government says that it’s trying to protect.

2. Speaking of which, by focusing on preserving capital instead of putting it to work, the government has created a punitive atmosphere for the small businesses in this country, which make up a huge percentage of our economy. They’ve also punished those who have been prudent with their money, while involuntarily redistributing wealth to those who haven’t. This has got to stop: A country that erodes economic initiative erodes its own wealth. That’s been very well documented through history, and is beyond dispute.

3. Outlaw non-deliverable credit default swaps (CDS) and force Wall Street to act in the best interests of the customer, instead of in its own. Thanks to huge conflicts of interest – as well as a toothless regulatory structure – Wall Street is actually depriving Main Street of huge amounts of money and opportunity, while enriching itself.

4. Quit bailing out companies that should fail. History is littered with the bones of failed companies. Whenever I hear the term “too big to fail,” I want to ask our leaders why they didn’t use the anti-monopoly statutes already on the books to keep companies from reaching the point where their failure could actually damage the economy – meaning that they have to be rescued. The sad result of this is that the risks are more concentrated now than they ever have been. And bonuses are bigger than ever for a very select few of Wall Street’s modern-day buccaneers.

5. Simplify our tax code. At 8 million lines, it’s totally out of control and impenetrable to businesses and individuals alike – not to mention cumbersome and expensive to deal with. A simpler tax code would encourage more investment, would lead to higher profits … and would result in greater job creation.

6. Privatize Social Security. Where is it written that the government is the risk-taker of last resort? And for all those Americans who are worried that Social Security might go bankrupt … well, I’ve got news for you – it’s already there.

7. Slash federal spending. There’s a longtime axiom among professional traders: Big Government = Small Wallets. Pure and simple. There is no such thing as a multiplier effect and every government dollar spent actually replaces a dollar from the private sector. The very notion that the government can spend money more efficiently than private enterprise is badly flawed and robs this country of wealth at all levels. If the government’s “investment multiplier” actually worked, our economy would be screaming along at 5% to 8% or more.

8. Stop the freeloading and engage in immediate pension reform. We cannot live on free money forever, which is why we’ve got to push federal, state and local pensions into 401(k)-like systems. The very notion of a lifetime pension is not only preposterous, but robs the system of badly needed wealth in the process – perhaps Congress is nervous about this because it’s another case of what’s good for the goose is not good for the gander. Congressional members have a really fat pension as it is.On that note, I want to offer one final observation. The president and various members of the political establishment have often said that like American families who have had to sacrifice, the government must also. Then, President Obama announces a spending freeze at current levels, which are up 25% over the last two years and congressional aides announce that the 2011 budget deficit may hit $1.5 trillion, up from $1.3 trillion. To politicians, not increasing their spending of your money, that is apparently the real sacrifice.

[Editor’s Note: U.S. government strategies like the ones that President Barack Obama outlined in Tuesday night’s State of the Union address virtually guarantee that we’ll see $150-a-barrel oil – perhaps as soon as mid-summer. A price increase of that magnitude could result in the $5-a-gallon gasoline that Money Morning’s Keith Fitz-Gerald referenced in the preceding interview.

But here’s the thing …

You don’t have to be a victim.

If you follow our lead, you’ll be among the small group of investors who make a great deal of money in the new-reality markets – such as the “BEE” markets that Fitz-Gerald referred to in today’s interview. There are major profits to be made – even with investments that will enable you to navigate this unsettling economic storm. And these investments will even help you reach a welcome port on the other side of this historic squall.

To find out about these opportunities – and about the investments that Fitz-Gerald is recommending right now – check out the “2011 Investor’s Forecast” issue published by our monthly affiliate newsletter, The Money Map Report.

If you are already an MMR subscriber, you already have this issue in hand, and can access this report by clicking here and then using your password. That will provide MMR subscribers with access to Fitz-Gerald’s recommendations in the “Forecast” issue.

Money Morning readers who are interested in finding out more about our forecast issue can do so by clicking here.

Look at it this way: When oil reaches $150 a barrel and gasoline costs more than $5 a gallon, the economic pain experienced by most consumers will be intense. But for smart investors, the profit potential will be immense.

Which group would you rather be part of?]

Original Article by Investment Strategist Keith Fitz-Gerald, Money Morning

Related Stories & News

https://fastcashforex.com/category/currency/trading-currency/commodities-trading-currency-currency/

https://fastcashforex.com/2011/01/fed-keeps-pedal-to-the-metal-as-egypt-unrest-weighs-on-markets/

https://fastcashforex.com/2010/12/profit-from-the-one-company-that-will-win-the-mobile-internet-gold-rush/

Best Investments for 2011