This gallery contains 0 photos →

This gallery contains 0 photos →

Investing for retirement is more complicated than opening an IRA or maxing out your 401(k). In fact, according to a 2010 survey by Charles Schwab of people 50 and older, nearly one in three say they find investing for retirement a bigger challenge than dealing with expenses or saving money. And no wonder: Pensions have mostly given way to so-called defined-contribution plans — think 401(k), 403 (b) and 457 plan — which have placed the burden of investing to provide for a steady income on your shoulders.

Investing for retirement is more complicated than opening an IRA or maxing out your 401(k). In fact, according to a 2010 survey by Charles Schwab of people 50 and older, nearly one in three say they find investing for retirement a bigger challenge than dealing with expenses or saving money. And no wonder: Pensions have mostly given way to so-called defined-contribution plans — think 401(k), 403 (b) and 457 plan — which have placed the burden of investing to provide for a steady income on your shoulders.

Park your money in the right accounts. The U.S. tax code offers several advantages for retirement investors. Many Investment companies offer free booklets on diversifying your retirement portfolio and making the right decision.

Focus on asset allocation. One key study shows that 91% of a portfolio’s performance is determined by the allocation of assets, not individual investments or market timing.

Pick the right investments. Misguided investment choices can cost you tens of thousands of dollars over a lifetime.

Diversify.

Diversification is Important

A basic diversified portfolio might include several investment categories such as stocks, bonds, Secured Cryptocurrency (Digital Money) and cash. ( Don’t put all of your eggs in one basket.)

Find out more about transferring an existing IRA, SEP, 401(k), 403(b) or TSP plan into physical precious metals.

Why is gold so valuable? Is Your Money Safe in Bank Accounts?

Gold has the highest corrosion resistance of all the metals and it is corroded only by a mixture of nitric and hydrochloric acid. Gold does not oxidize.

Wall Street Journal lists gold as a commodity and considers gold as a currency, Gold continues to hold it’s value even in times of war or crisis. Investors turn to Gold as safe-haven in times of geopolitical crises. Historically, Gold outperformed cash sitting in banks.

Of all the precious metals, Gold is the most popular as an investment, Investors buy Gold as a way of diversifying risk, Gold has the most effective safe haven and hedging properties across many countries

Central banks are storing gold. China, Russia and numerous Asian and West Asian national banks have begun buying and storing gold.

For the stock portion of your portfolio, consider index funds and mutual funds and get exposure to domestic and international markets, as well as small, medium and large-cap stocks; for the fixed income portion of your portfolio consider bonds, bond funds, CDs or possibly real estate or commodities.

Ask for help. A financial adviser can help you pick low-cost investments to help you meet your retirement goals. Be mindful, however, of how that adviser gets paid.

Select a range of investments for optimal diversification. Find a financial advisor using NAPFA.org.

What not to do. Think rationally, not emotionally.

Drips may be one of the surest, steadiest ways to build wealth over your lifetime (just make sure you keep good records for tax purposes

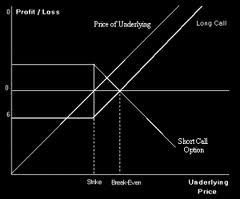

After the stock market’s crazy patch, experts show how to best use the so-called alternative mutual funds flooding the market.

Stock-shocked investors are fleeing to gold, pushing the precious metal to new heights.

Gold reached a new intraday high of $1,782.50 per ounce in electronic trading before backing down to $1,746.20. That’s an increase of $33, or about 2%, compared to its Monday close. On Monday, gold broke $1,700 for the first time.

The current flight to gold has been by a nasty stock market plunge. On Monday, the Dow Jones industrial average plummeted 624 points, or about 5.5%, and the Nasdaq and S&P 500 dropped nearly 7%. It was the worst day on Wall Street since the 2008 fiscal crisis.