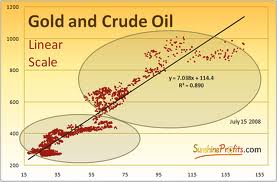

By REUTERS – NEW YORK/LONDON: Crude oil prices fell on Tuesday after a meeting between French and German leaders failed to ease concerns about the euro zone debt crisis.

By REUTERS – NEW YORK/LONDON: Crude oil prices fell on Tuesday after a meeting between French and German leaders failed to ease concerns about the euro zone debt crisis.

Concerns about the debt crisis have weighed on oil markets in recent weeks, adding to worries about weak US economic data that could hit fuel demand.

“It doesn’t look like the two biggest items were seriously discussed today — the potential for a euro bond and the size of the stabilization/bailout fund,” said Edward Meir, senior commodity analyst for MF Global in New York.

Crude prices dropped before the meeting as data showed sluggish German growth hobbled the euro zone, dragging US stocks. The euro slid against the dollar.

September Brent crude futures fell 41 cents to $109.50 a barrel by 13:32 p.m. EDT (1732 GMT) in thin trading ahead of the contract’s expiry later on Tuesday. The more heavily traded October contract traded gave up 79 cents to trade at $109.05 a barrel.

US crude fell $1.26 to $86.62 a barrel, having touched an intraday low of $85.62 a barrel.

In early afternoon trade in New York, Brent crude trading volumes were 29 percent below the 30-day moving average while US crude trading volumes were 22 percent off the average.

“It is still vacation, and we will likely remain range-bound over the next two weeks,” said Richard Ilczyszyn, senior market strategist at MF Global in Chicago. “Once we have a direction for crude, we will see big money come back in.”

Implied volatility, as measured by the Chicago Board Options Exchange’s Oil Volatility Index, while up modestly on the day, remained firmly entrenched in a four-day downward move Tuesday, as underlying crude oil prices on NYMEX traded within an established range.

At midday Tuesday, the index was pegged at 44.98 percent, down from its intraday high of 46.67 percent and just above its opening level of 44.47 percent, off the two-year high of 70.37 percent hit on Aug. 10.

Global stocks and the euro slid on Tuesday. The euro was down 0.27 percent. The benchmark 10-year US Treasury note rose 17/32 in price to yield at 2.25 percent, down from 2.30 percent earlier in the session.

US stocks fell after three days of gains and global stocks, as measured by MSCI’s all-world equity index were off 0.9 percent.

The Dow Jones Industrial Average was down 164.08 points, or 1.43 percent, at 11,318.82. The Standard & Poor’s 500 Index was down 20.91 points, or 1.74 percent, at 1,183.58. The Nasdaq Composite Index was down 54.96 points, or 2.15 percent, at 2,500.24.

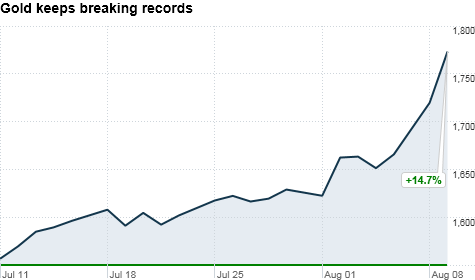

The dollar was up against a basket of major currencies, with the US Dollar Index up 0.27 percent at 74.035. The euro was down 0.37 percent at $1.4391. Spot gold prices rose $16.26 to $1,781.20 an ounce.