This gallery contains 1 photo →

This gallery contains 1 photo →

This gallery contains 1 photo →

Adobe Stock

As most of us are in lockdown at home, we are left to wonder what a post-coronavirus-world might look like. There’s a lot unknown about how the world will transform after we get the novel coronavirus under control, but it is extremely unlikely that things will just go back to exactly the way they were before. Our workplaces are likely to change, and with it, the skills companies will require. Here are 8 job skills that are likely to be in high demand in a post-coronavirus world.

Adaptability and Flexibility

One thing is for certain, the ways companies operate and work are going to change. The world was already changing rapidly, but the pandemic accelerated it. There will be few “jobs for life.” Someone that is going to succeed in a post-coronavirus-world will need to be able to adapt to ever-evolving workplaces and have the ability to continuously update and refresh their skills.

Tech Savviness

One of the best ways to prepare yourself for a post-coronavirus-world is to acquire technology skills. The COVID-19 pandemic is fast-tracking digital transformations in companies as they are trying to become more resilient to future outbreaks and disruptions. The reality is that technologies such as artificial intelligence, big data, the Internet of Things, virtual and augmented reality, and robotics will make businesses more resilient to future pandemics, and anyone that can help companies exploit these technologies will be in a great position. Whether you work in a factory or an accounting office in a post-coronavirus world, you need to be comfortable with these tech tools as well as be able to work with them effectively.

Creativity & Innovation

We have already seen the importance of creativity and innovation during the pandemic. Businesses that have been able to come up with ways to deliver services virtually (like many healthcare providers have done) or quickly shift to new products (like Mercedes F1 that have shifted from making racing cars to innovative breathing aids) have been able to better weather the storm. In a post-coronavirus world, we will need human ingenuity to invent, dream up new products and ways of working. Human creativity is going to be essential.

Data Literacy

As the fuel of the 4th Industrial Revolution, data is a critical asset for every company. With the right data, companies are able to better predict the impact of future business disruptions and are better able to serve customers with the right products and services during or after any pandemic. Companies that understand business trends and shifting customer needs are better able to respond in the right way should a future pandemic come along. However, the data is useless to a company unless there is data literacy—people equipped with skills to understand the data and make better decisions because of it. Professionals with data literacy will be even more appealing to prospective employers than ever before.

Critical Thinking

Another skill that will be essential as our global economy rebuilds from the damage done by COVID-19 is critical thinking. During the pandemic, we have seen a spike in fake news and misrepresentations of data and studies, as leaders, businesses, and governments are trying to shift blame and divert attention and proper scrutiny.

People who can objectively evaluate information from diverse sources to determine what is credible will be valued. Not all information should be trusted, but organizations will need to rely on critical thinking to understand what information should inform decision-making.

Digital And Coding Skills

The digital transformation of organizations got a boost because of coronavirus; therefore, professionals with digital skills, including coding, web development, and digital marketing, will become even more important than they are now. People who can keep the digital business running—and thriving—during economic downturns or pandemics that make in-person business impossible or less efficient are going to be on the must-hire list. And, basically, ALL companies are now digitally based in some way, so the opportunities to put digital skills to work are countless.

Leadership

One of the changes in a world that are heavily augmented by the support of machines and where social distancing and home working might continue for the foreseeable future, is that more people at all levels of an organization will be in a position where they lead others. The gig economy is only going to grow post coronavirus, and people will be working in more fluent teams where people are taking the lead at different times. Professionals with strong skills in leadership, including how to bring out the best and inspire teams as well as encourage collaboration, will be in demand.

Emotional Intelligence

Closely linked to leadership is another skill that is even more important in uncertain and challenging times: Emotional Intelligence (EQ). The ability to be aware of, express, and control our emotions and be aware of others’ emotions is what emotional intelligence is all about. At times when people might feel uncertain about their job and the future of their business, it is key to connect with people on an emotional level. Individuals with strong EQ will be coveted by organizations of all sizes and in all industries.

Commit to a Lifetime of Learning

According to the World Economic Forum, in just five years, 35 percent of the skills deemed essential today will change. There’s only one way to remain relevant in a post-coronavirus reality: commit to a lifetime of learning.

When faced with a tight job market, professionals with advanced and expert job skills will still be in demand and will likely struggle less to find employment. The good news is that improving your skills has never been easier. Today, it doesn’t require years of study or hefty loans to build up your skillset to be prepared for a post-coronavirus world. There are endless free and open online courses (MOOCs) available that will help you improve your skills.

Here are just a few examples:

· Artificial intelligence and machine learning courses

· Data literacy and data science courses

· Emotional Intelligence courses

Or just search for the skills you want to develop on platforms such as Coursera, edX, Udacity, FutureLearn, or iversity.

See lockdown as an opportunity to improve your skills so that you are ready for the post-coronavirus job market.

ready for the post-coronavirus job market.

Source- Forbes- Bernard Marr

Black Friday is almost here, and with it comes the annual shopping bonanza that kicks off the holiday season. The shopping weekend, which extends through Cyber Monday, isn’t just an opportunity for shoppers to get some of the best…

This gallery contains 1 photo →

This gallery contains 2 photos →

This gallery contains 1 photo →

This gallery contains 1 photo →

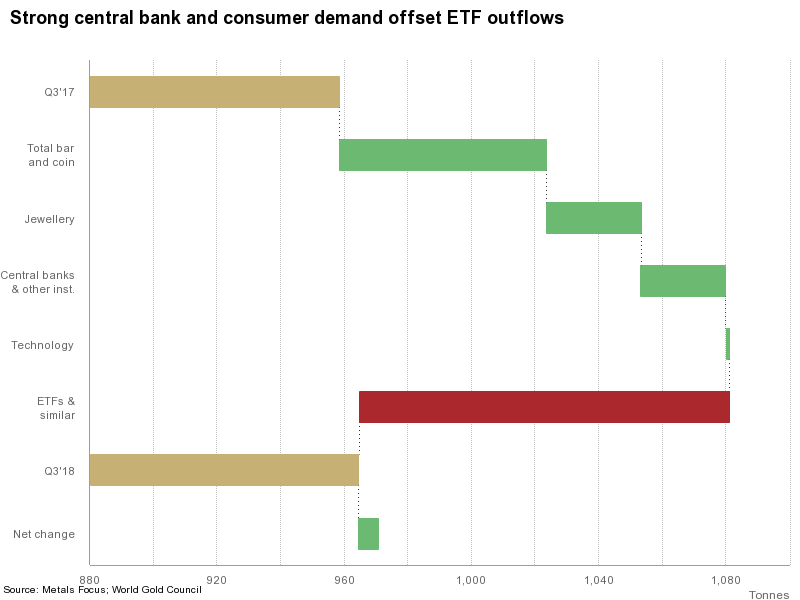

Mistakes You Want To Avoid When Buying Gold for Investment!

1-Avoid buying proof coins if you are buying gold as an investment. Proof coinage means special early samples of a coin issue, historically made for checking the dies and for archival purposes, but nowadays often struck in greater numbers especially for coin collectors (numismatists). Nearly all countries have issued proof coinage.

2-Avoid European Coins

They are not worth the high price, dealers promoting European coins because they provide bigger profits and clients have no chance of making any future profit.

3-Avoid Investing in Exploration Mining Stocks

it’s so difficult to find a mine. Only one in about 500 deposits that they drill actually become a mine.

You can always profit from the long-term investment, Investors should take a longer-term investment of minimum 7yrs, you will do well especially if you put your money in equity mutual funds with a good in performance in different market cycles!…

A diversified portfolio should have the followings;

Gold and Cash are essential, Property Flipping for profit, Currency Trading, Property and treasury securities.