Gold ended last week with heavy losses after the metal failed to sustain the gains versus the strong dollar and amid a heavy selloff on commodities.

Gold ended last week with heavy losses after the metal failed to sustain the gains versus the strong dollar and amid a heavy selloff on commodities.

The market sentiment remained very fragile last week and gold marginally did rise to its status as a safe haven until the selloff turned violent on commodities driven by a broad selloff on crude oil.

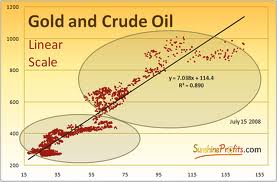

Last week the heavy downside pressure on gold was mostly evident at the time the IEA said it will release stocks to compensate Libya’s supply which trigger a strong selloff on crude which pressured gold down with it.

This week, the downside pressures on gold might still be evident this week as the metal broke through critical support levels and accordingly the liquidations might still be evident especially amid heavy volatility in the market.

Some upside support might still be seen from the debt crisis as investors will keep their focus on the parliament vote in Greece on the austerity package. If the measures pass the dollar might weaken and a wave of optimism might be seen which will offset the pressure on gold, yet if the motion was denied gold will rise slightly on haven demand yet might then be pressured on heavy liquidations.

More volatility will be evident in the week ahead with the prevailing jitters over the debt crisis and slowing global growth. The weak oil might persist as downside pressure on gold so is the metal’s inability to hold above $1549-1550 and therefore the losses might continue for the precious yellow on liquidations yet there remains a good chance for upside pullbacks this week with the prevailing uncertainty and haven demand.

Other stories

How to Invest in Gold

Invest in Gold

Gold prices will hit $2,500 in the near future

Global Investing Strategies

Different Investment Methods

Trade Spot Gold Online

Trade Oil Online

Trade Commodities Online

The Basics of Oil Trading

Oil could reach $300 a Barrel

Stocks Rally After Three-Day Slide; Oil, Commodities Advance, Euro Weakens