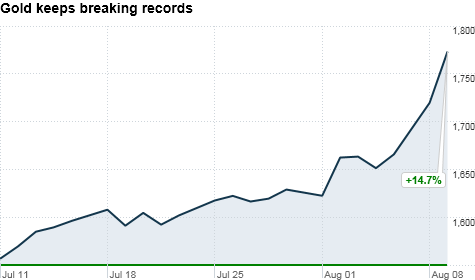

As Gold Briefly Hits $1,800, Traders Fear Party Is Ending

As Gold Briefly Hits $1,800, Traders Fear Party Is Ending

As gold topped a record $1800 on Wednesday, traders that are long gold [GCCV1 1751.50  -32.80 (-1.84%)

-32.80 (-1.84%) ![]() ] began to get nervous that they were behind a trade that may not have any potential new buyers left. After all, a trade only keeps working if you can find someone else who wants that particularly security or commodity at a higher price.

] began to get nervous that they were behind a trade that may not have any potential new buyers left. After all, a trade only keeps working if you can find someone else who wants that particularly security or commodity at a higher price.

First let’s look at the cold data.

On Aug. 2, holding by large gold speculators—namely hedge funds—hit “readings that are the highest ever in our records,” stated a Bank of America Merrill Lynch analysis of CFTC data.

The $40.6 billion notional value of gold contracts held by speculators was up from $38.1 billion a week earlier, according to the Merrill Lynch number crunching.

But more importantly, the chatter on trading floors is about a fear that the market turmoil lately could trigger large hedge funds to raise money by selling one of the few things working for them: gold.

Take John Paulson, the legendary housing market short. His Paulson Advantage Plus Fund is down more than 31 percent this year because of sour bets on financials like Bank of America [BAC 7.25 0.48 (+7.09%) ]. Yet his firm still counts gold investments amongst its largest holdings.

“The risk to the latest bull leg being kicked out is redemptions at large hedge funds that have a significant stake in gold,” said Brian Kelly of Brian Kelly Capital, who has sold 90 percent of his gold position. “The dreaded forced selling.”

“Truth is no one else knows where else to put their money, but as soon as a Soros-like figure exits his massive gold position, there will be a huge panic sell-off,” said a trader at one of the more sizeable commodity trading firms who wished to remain anonymous. “Just in terms of simple mean reversion, it looks like we could easily snap back to the 1550-1600 level at the blink of an eye.”

One massive bullish force and potential perpetual buyer of gold are central banks. With almost every country in the world actively trying to devalue their own currency in order to lift asset prices, gold, in effect, has become the only real store of value left.

Original Story BY: JOHN MELLOY-CNBC On Thursday, 11 Aug 2011 | 4:23 PM ET

Similar Stories

How to Invest in Gold

Invest in Gold

Gold prices will hit $2,500 in the near future

Trade Spot Gold Online