How to Beat the Market: The New Momentum Strategy

How to Beat the Market: The New Momentum Strategy

The 2008 market meltdown called into question the old buy-and-hold dogma. Momentum investing, the notion that you ride rising stocks, got discredited after the dot-com blow-up. It is back – but with a difference. Matthew Tuttle, one of the smartest money managers in the advisor world, is a proponent of a new style of momentum. Tuttle, who heads Tuttle Wealth Management in Stamford, Conn., is worth listening to.

After dealing with multiple market blowups, many investors question the strategy of simply buying a stock index and hoping for the market to improve by the time they retire. I believe that more active strategy is the better way to build wealth and make sure that a down market doesn’t wreck your savings.

In numerous studies, several investing strategies – such as value, momentum and small- and low-beta stocks – have proven to outperform the market.

Value investing is a popular approach that famous investors like Warren Buffett and Bill Mhttp://fastcashforex.com/wp-admin/post-new.phpiller advocate. This involves researching companies and finding those with strong fundamentals that the market doesn’t yet appreciate. Buy them at bargain prices, and when the market comes around and gives them a higher valuation, you can sell the stocks for more.

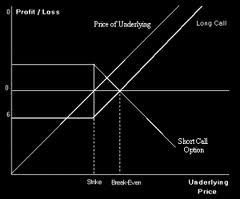

Momentum involves finding stocks that are the strongest, and are the likeliest to trade higher. In a bear market, that means buying the ones that dropped the least. When they start to lose momentum, you get out of the position. Where value investors buy low and sell hihttp://fastcashforex.com/wp-admin/post-new.phpgh, momentum investors buy high and sell higher.

Smaller stocks can be good because big institutional investors such as mutual funds might not even be allowed to invest in them, even if they have strong fundamentals. You might find a small-cap stock with an attractive price that the bigger players aren’t able to inflate.

Low beta stocks are a less risky component of a portfolio. Beta measures a stock’s volatility relative to the market. Stocks with high beta are riskier, but potentially more rewarding. When the market goes up, low beta stocks go up by less, but when the market is down, those stocks don’t go down as much.

Momentum is one of our favorite strategies. Momentum strategies can help investors beat the market and avoid crashes, when coupled with trend-following, which focuses only on stocks that are gaining. My firm is also very interested in value, since it is not correlated with momentum. We are constantly studying ways to apply value across asset classes and see how it can be combined with momentum strategies. Momentum is the only one of these factors that can be tweaked to avoid large losses.

Lately, we have been thinking about combining relative strength (buying the one asset out of a basket of assets that has the strongest performance over time) with value, momentum, low beta and small stocks investing. So I decided to study whether this would work. I found exchange-traded funds or mutual funds to represent each. I found the following portfolio that would have delivered a substantial average annual return:

Momentum: PowerShares DWA Technical Leaders (PDP)

Low Beta: SEI Managed Volatility (SVOAX)

Value: iShares Large Cap Value (IVE)

Small-Cap: iShares Russell 2000 (IWM)

For diversification, I also included PIMCO All Asset (PAAIX). I also designed a simple relative strength system, which measures how different assets trade compared to one another. The system rotates monthly among the best performing funds and goes to cash if nothing is in an uptrend. I went back to Feb. 25, 2009, when the bear market was ending. Here are the results from then until Oct. 4:

Average Annual Return: 21.11%

Lowest Point: -15.37%

Worst Month: -7.16%

Sharpe Ratio: 1.32

MAR Ratio: 1.37

The performance numbers and the MAR and Sharpe Ratios (two measures that compare risk to rewards) are very attractive. However, the drawdowns and worst month are a little high for my taste. Still, this experiment has sparked my interest and I will study these strategies further.