* World stocks hit by losses again

* Wall Street down as much as 6 percent

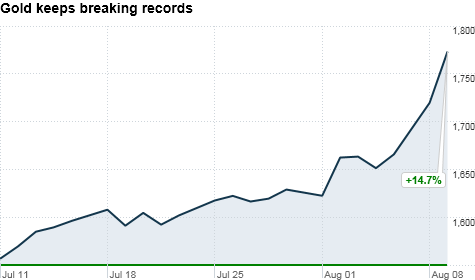

* Gold hits record above $1,700 an ounce

* Italian, Spanish bond yields drop on ECB buying (Updates prices, adds details, quote)

NEW YORK, Aug 8 (Reuters) - U.S. stocks plunged on Monday and investors fled to the safety of gold and bonds after the downgrade of the U.S. credit rating by Standard & Poor's stoked fears the United States is slipping into recession.

Wall Street slumped as much as 6 percent by mid-afternoon and European stocks hit a two-year low. A favored gauge of investor anxiety spiked well above 40, a sign investors are afraid of more declines to come. The CBOE Volatility Index .VIX surged 41.9 percent at 45.40.

Investors were struggling to discern the effects of the U.S. credit rating downgrade to AA-plus from AAA, which could hit various components of the vast U.S. financial sector, from mortgage lenders to municipal issuers and insurers.

"This is all a new trading paradigm, no one has ever experienced anything like this before. It's going to take the market and investors a couple of days to comprehend what is actually happening," said Dean Popplewell, chief currency strategist at Oanda in Toronto.

"We have just seen panic liquidation -- does it have the legs to continue is obviously the next question."

Investors took shelter in the asset that was downgraded -- choosing U.S. government bonds for their liquidity and perceived high quality.

The downgrade -- and threats of subsequent moves by S&P or other rating agencies -- raises uncertainty about the credibility of the United States in the global economy as investors worry about another recession.

Central to S&P's argument was that political paralysis in Washington has reached a point where the government would be unable to deal with worsening deficits and sagging economic growth. This burdens a stock market already skittish after last week's outbreak of fear.

U.S. President Barack Obama blamed the downgrade on political gridlock in Washington and said he would offer some recommendations on how to reduce federal deficits.

"In many ways this is not about the downgrade. I think it's about the underlying fundamentals and issues that are embodied in the downgrade itself," said Jonathan Golub, chief U.S. equity strategist at UBS in New York.

MSCI's all-country world stock index .MIWD00000PUS dropped 4.6 percent to its lowest since September 2010. The sell-off since July 29 has wiped at least $3.4 trillion off the value of global stocks, the equivalent of Germany's gross domestic product.

Monday's rush for the exits extinguished any relief from news the European Central Bank was buying Italian and Spanish government bonds in the latest move to staunch the euro zone debt crisis.

SEARCH FOR SAFETY

Several major brokerages have in recent days lowered their expectations for U.S. economic growth and share appreciation for 2011 and 2012.

Moody's repeated a warning it could downgrade the United States before 2013 if the fiscal or economic outlook weakened significantly. It said it saw the potential for a new deal in Washington to cut the budget deficit before then.

Investors looking for a safe place to park their money pushed gold XAU= to a record high above $1,700 an ounce. The U.S. dollar dropped against the Swiss franc and yen. The euro fell against the dollar.

The euro EUR=EBS hit a record low against the Swiss franc, falling as low as 1.0640 Swiss francs EURCHF=EBS. It also lost 2 percent versus the yen EURJPY=R.

The dollar JPY=EBS fell 0.6 percent to 77.62 yen and was down 1.8 percent at 0.7538 Swiss franc CHF=EBS.

Benchmark 10-year Treasury note yields fell to their lowest levels since February 2009. The notes rose over two points in price, with yields US10YT=RR falling as low as 2.33 percent, the lowest rate in two-and-a-half years.

European shares closed down 4 percent after registering gains on the ECB action. The FTSEurofirst 300 index .FTEU3 has lost about 21 percent since a peak in mid-February, putting it in bear market territory.

The Dow Jones industrial average .DJI dropped 504.47 points, or 4.41 percent, to 10,940.14. The Standard & Poor's 500 Index .SPX slid 67.41 points, or 5.62 percent, to 1,131.97. The Nasdaq Composite Index .IXIC sank 145.38 points, or 5.74 percent, to 2,387.03.

There have been 26 other days since 2000 when the market has been down more than 3 percent at noon, according to Birinyi Associates Inc. On average, 85 percent of the time the market continues lower until the close for a further 1 percent fall. (Additional reporting by Ashley Lau, Chuck Mikolajczak and Edward Krudy in New York and Atul Prakash and Jeremy Gaunt in London; Editing by Andrew Hay) Original Story By: REUTERS Other Related Stories Wall Street to Brokers: Investors Should buy not Flee Stocks plunge as Economic Europe Worries Continue